What the BAHFA?

A short primer on affordable housing, BAHFA and BAHA, and potentially game-changing funding!

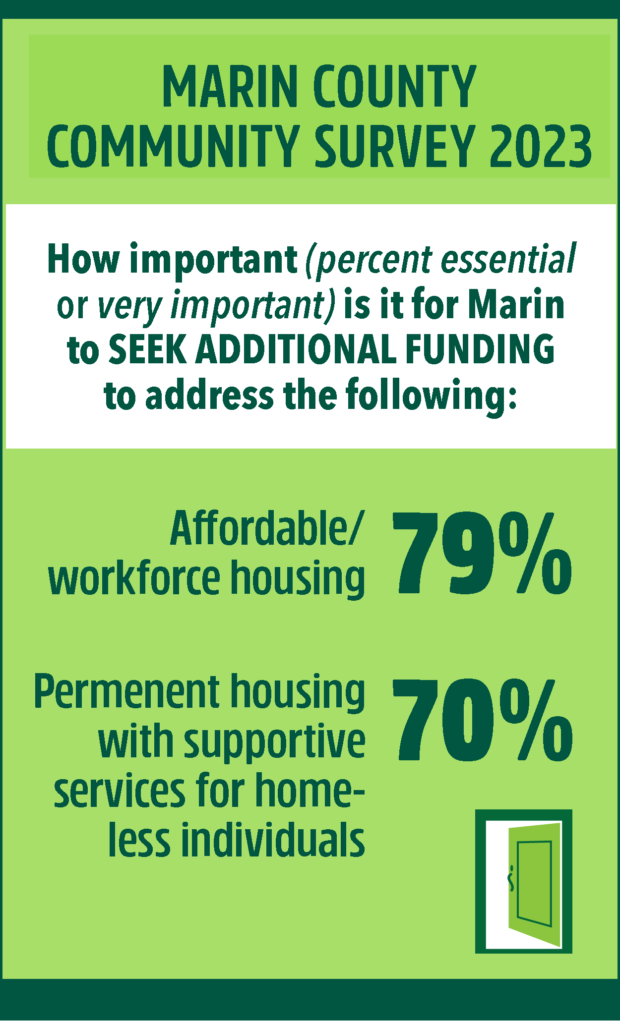

Marinites overwhelmingly want more affordable housing.

According to the Marin County 2023 Community Survey, it is the #1 issue that Marinites would like our local governments to address. But how can we build more affordable housing? And what does this have to do with the Bay Area Housing Finance Authority (BAHFA) and the bonds planned for the November 2024 election?

If you’re not familiar with BAHFA (the acronym is pronounced “bah – fah”), you are not alone. BAHFA is a new agency that was established in 2019 to support the construction of new affordable housing and preservation of existing housing in the Bay Area. To support these goals, BAHFA is now working on a $10 – $20 billion regional bond to increase available funds for affordable housing. The amount will be finalized this summer. Eighty percent of the funds generated in Marin – between $350 and $700 million – will be returned to Marin for distribution according to a Marin County-developed expenditure plan. The remaining 20% will go to the BAHFA agency for region-wide initiatives.

Why is this a big deal? Why are so many people calling this “game-changing?”

To understand the enormous impact the BAHFA bonds can have, it helps to understand how affordable housing is financed today. For an overview of affordable housing financing, you can read our primer on Affordable Housing Financing. This is truly a primer – to cover all the nuances and complexity of our current system would require a PhD dissertation. The short version is that our current affordable housing financing system is both underfunded and wildly dysfunctional. It requires regulatory wizards to study and navigate the system and put all the pieces together to make projects happen. The complexity of the system slows development and increases costs, making affordable housing units more expensive to build than market rate units.

BAHFA bonds won’t fix all the problems with our system. But they are a great start.

The bonds will provide a large funding source, and funding is desperately needed. There are currently many shovel-ready units ready to be built that are waiting their turn for funding. A $20 billion bond has the ability to double the number of affordable units that could be developed in the Bay Area. Almost all affordable rental housing in California is partially financed through the federal Low-Income Housing Tax Credit (LIHTC) program. This program is oversubscribed. The state of California administers additional affordable housing financing through the California Super-NOFA (Notice of Financing Availability). Last cycle, the Super-NOFA received qualifying requests for 10 times as much funding as was available. There are viable projects ready to be built today that just need the funding to go ahead. BAHFA can move these projects forward.

But the BAHFA bonds will do more than just provide funding. The size of this potential funding source holds the potential to greatly simplify the process for financing affordable housing projects in Marin. Today, the typical affordable housing project requires funding from 6-8 different sources, sometimes more. Each funding source:

- adds complexity to the project;

- has its own monitoring and reporting system to provide the oversight of the funding;

- has different deadlines and requirements for receiving funding (missing a deadline by just a few days can delay a project by a year); and

- has unique criteria and mandates for the projects it funds, from services provided (free WiFi, after-school programming and/or case managers) to labor standards to use of environmentally sustainable materials.

While each requirement has a well-meaning justification behind it, the mix of requirements don’t necessarily play well together, which has the consequence of raising the cost of building affordable housing compared to market rate housing. Further, this mix of sources and requirements greatly increases the management overhead of each project. It takes skill and diligence to obtain these funding sources and navigate these sources.

A large funding source like BAHFA has the potential to greatly simplify this process. Projects could potentially get funded with 3-4 rather than 6-8 funding sources, which would lower costs and speed production. It could also change the make-up of who gets to build affordable housing. There is great desire to diversify the builders of affordable housing. However, the current financing structure makes it a very difficult field to enter. Developers need both high regulatory skill and knowledge and very deep pockets. Going from project concept to funding can take years and is very expensive. There is very little funding for pre-entitlement work – the creation and editing of site plans, the navigation of funding requirements, the prepping and attending numerous community meetings. Developers typically front the bulk of these costs until they receive construction funding. EAH, an affordable housing developer, estimates that they will spend $1,000,000 of their own capital before they receive funding for the building of 1 Hamilton, a 45-unit 100% affordable housing project recently approved in Mill Valley. While they expect they will be repaid these funds through the project, there are very few developers that can front that kind of money for a project. A simpler, more predictable process will open affordable housing development is a prerequisite to diversifying the field.

The bonds will generate a Marin-controlled funding source for affordable housing projects. Currently, all the affordable housing funding sources are competitive. Marin projects are competing for funding with other affordable housing projects in Sacramento, Chico and Los Angeles. Many of these projects are in areas that are much easier to build in. BAHFA funds will be ours. We get to determine how to allocate the funds, as long as we follow the general allocation guidelines. The development of the Marin County expenditure plan will be completed by Marin County. There is no other meaningful funding source with local control on how it is used.

The bonds will provide flexibility in how they are used to create and preserve affordable housing. Current funding sources are specialized.and only provide funding for limited types of projects. The BAHFA bond funding will be available for all the “3 P’s” of addressing the housing crisis:

- Production of new housing at all income levels, especially affordable housing:

- Preservation of existing housing affordable for lower- and middle-income residents; and

- Protection for current residents to avoid displacement.

The severity of Marin’s housing crisis is widely recognized. Residents want affordability to be addressed. The existing tools and funding sources are insufficient to solve our housing crisis. We need more. The BAHFA bonds are a great first step. More details on the bonds are available here.

Many thanks to Bianca Neumann and Sheri Joseph, who provided MEHC with a tutorial on this crazy non-profit funding system.

Endorse the BAHFA bond measure now at Bay Area Housing for All. If you are involved in any community groups, please encourage their endorsement also.

RESOURCES

Bay Area Housing Finance Authority (BAHFA)

BAHFA – The first regional housing finance authority in the state – More info here >>

MARIN COUNTY ELECTED OFFICIALS AND CANDIDATES WHO HAVE ENDORSED BAHFA:

Stephanie Moulton-Peters, Marin County Supervisor

Dennis Rodoni, Marin County Supervisor

Eric Lucan, Marin County Supervisor

Mary Sackett, Marin County Supervisor

Chance Cutrano, Mayor, Town of Fairfax

Lisel Blash, Councilmember, Town of Fairfax

Stephanie Hellman, Councilmember, Town of Fairfax

Urban Carmel, Mayor, Mill Valley

Rachel Farac, Councilmember, City of Novato

Rachel Kertz, Councilmember, City of San Rafael

Kate Colin, Mayor, San Rafael

Tarrell Kullaway, Councilmember, San Anselmo

Alexis Fineman, Councilmember, San Anselmo

Steve Burdo, Councilmember, San Anselmo

Brian Colbert, Councilmember, San Anselmo, Candidate for Marin County Supervisor

Janelle Kellman, Councilmember, Sausalito

Heather McPhail Sridharan, Candidate for Marin County Supervisor

IF YOUR REPRESENTATIVE ISN’T ON THIS LIST, PLEASE CONSIDER RESPECTFULLY CONTACTING THEM AND ASKING WHY!!

To learn more about financing and building affordable housing, see MEHC’s Primer on Affordable Housing

Also see the BAHFA explainer

CALL FOR ACTION – SHOW YOUR SUPPORT FOR AFFORDABLE HOUSING – ENDORSE TODAY!

Endorse Bay Area Housing for All –Join the solution to our Bay Area housing crisis. Your personal endorsement matters! Urge your representatives and organizations to endorse at bayareahousingforall.org

MEHC works for the Marin community

Many Marin workers, employers, residents and nonprofits support MEHC’s work to advance environmentally appropriate, culturally sensitive, and socially equitable affordable housing. If that includes you, please consider a tax-deductible donation to MEHC to help us keep working.

Your support matters, thank you.

|